Bank statement letter refers to a statement that is issued by your bank, confirming your account activity over a specified period of time.

In this article, we’re going to share everything you need to know about a bank statement letter, including how to request one.

And, we will also be answering common questions that we receive about bank statements from our members.

This article is part of our free series on bank reference letters which you can access by clicking here.

Feel free to use the table of contents to jump ahead to the sections most relevant to you.

Table of Contents

A bank statement letter is an official document from a financial institution that can act as proof of funds, income verification, or account verification of a bank account. It is a reflection of an individual’s banking records and a statement of account.

Depending on the bank and the jurisdiction where the bank statement letter is being requested, a bank statement letter can either take the form of an account statement or a more formal financial statement.

In the following sections, we will outline how to obtain this verification letter in order to support your personal finance needs. This will include the steps to prepare a bank letter that you will submit to the financial institution where your accounts are held.

How you request a bank statement letter will depend on the jurisdiction where your accounts are held. Likewise, internal bank policies about issuing bank statements will also play a role in how you can obtain a bank statement letter.

For example, if you are in India, you will need to submit a formal letter to the branch manager where your account is managed. This letter will need to include specific information about you, your account, and the purpose of the letter.

On the other hand, if you are in the United States or another major financial center, you may be able to print out your bank statement from online banking without interacting with anyone at the bank.

Here is a closer look at a few of the ways that you can request a bank statement letter.

When obtaining a bank statement letter from an online bank account, you can typically download a PDF copy of your most recent monthly statements. Depending on the bank, they may provide access to the most recent six statements, twelve statements, or more. Additionally, after downloading a PDF copy of your bank statement, you can protect the PDF with a password for confidentiality by using a PDF password protector.

You can also choose to visit your bank in person and ask that the teller assist you with printing copies of your account statements within a certain time period. Importantly, as most banks are now moving online, this service is becoming less readily available and most banks will encourage you to download statements and print them at home.

If you have a business account and you want to request a bank statement letter, you can use both of the methods listed above as well. That said, if you do not have access to online banking for your business account, you may need to contact the branch manager directly and provide them with a formal request.

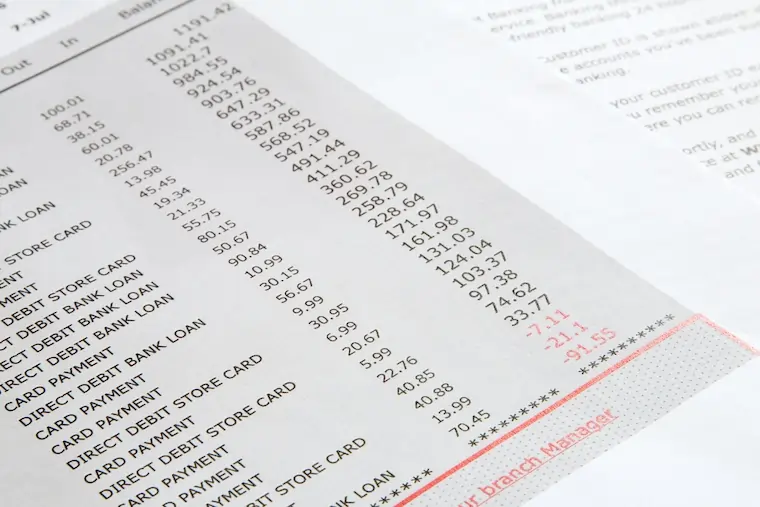

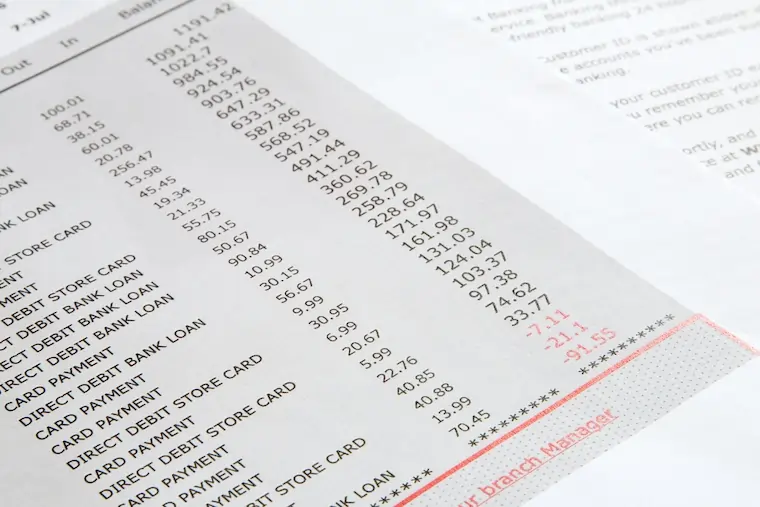

A bank statement letter typically includes information about the account holder, the financial institution, the account, and the specific transactions that have taken place within a specified time frame. Here is a closer look at each of these details.

Bank account transaction information is included in a bank statement letter for the specified period of time that the statements are presented. In most cases, bank account statements are grouped by month. However, if you have requested a custom time frame, then all of the transactions will be included for those dates.

Not surprisingly, this information will include all forms of transactions, including deposits, withdrawals, transfers, end of day and end of month balances, and more. Here is a closer look at these specific transaction details.

All of the deposits into the account within the dates of the bank account statement will be listed.

All of the withdrawals from the account within the dates of the bank account statement will be listed.

Any transfers into and out of the account within the dates of the bank account statement will be listed.

Both the end-of-day and end-of-month balances for the account are typically listed on an account statement as well.

Lastly, the account statement will also include important account information like account number, branch location, and information on the account holder.

Sign up here to receive our Free Non-Resident Banking Starter Guide and weekly updates on the best account opening options available:

Below are a few of the most common questions we receive from people looking into what a bank statement letter is. If you have further questions you would like to ask our team, don’t hesitate to get in touch.

A bank statement request letter is a formal letter that is sent to a bank in order to receive an account statement. The bank statement request letter needs to include information about the account holder, including name, identification number, address, and account number. Additionally, it needs to include the period of the statement and the reason for requesting.

You can request a bank statement in person by visiting the branch where your bank account is held. Of course, if your bank allows you to print statements online, then you will not need to visit a branch. Instead, you can access a bank statement letter without leaving home.

You can get a bank statement letter by requesting one directly from your bank. Alternatively, you can download a recent bank statement from your online account. Of course, certain jurisdictions may require a more formal process. This can include requesting a bank statement letter by contacting your bank directly.

If so, you can get access to GlobalBanks IQ in just a few clicks.

GlobalBanks IQ is our flagship international account opening solution. It gives you instant access to the…

+ Expert insights on which banks to choose & why

+ Step-by-step reports to open accounts in the best banking hubs

+ GlobalBanks international bank database & detailed bank profiles

+ Tried & tested banks for high-risk, offshore, & non-resident clients

+ Plus, get YOUR most pressing bank account opening questions answered by our team!

And “yes!” GlobalBanks IQ helps foreigners and non-resident individuals open bank accounts.

In fact, GlobalBanks IQ even helps non-resident, foreign & offshore entities open bank accounts.

Use the link in our menu above to learn more about GlobalBanks IQ. Or, contact us directly with any questions!

Share This Article on Your Favorite PlatformThe GlobalBanks editorial team comprises a group of subject-matter experts from across the banking world, including former bankers, analysts, investors, and entrepreneurs. All have in-depth knowledge and experience in various aspects of international banking. In particular, they have expertise in banking for foreigners, non-residents, and both foreign and offshore companies.