“Beneficial owner is a person who is free to decide whether or not the capital or other assets should be used or made available for use by others (i.e., the right over capital), or how the yields from them should be used (i.e., the right over income), or both”

“A person is said to be a beneficial owner of shares when they are held by someone else on his behalf, meaning thereby that the registered owner is different from the actual or the beneficial owner. Where the shares are not so held by one for and on behalf of another, the concept of beneficial ownership cannot be invoked.”

The term ‘beneficial owner’ is predominantly used in Articles governing taxation of dividend, interest, royalty and FTS under their respective clauses of 2017 OECD Model Convention.

Article 10 – Dividends

Article 12 – Royalties

a) 5 per cent of the gross amount of the dividends if the beneficial owner is a company which holds directly at least 25 per cent of the capital of the company paying the dividends throughout a 365 day period that includes the day of the payment of the dividend (for the purpose of computing that period, no account shall be taken of changes of ownership that would directly result from a corporate reorganisation, such as a merger or divisive reorganisation, of the company that holds the shares or that pays the dividend);

b) 15 per cent of the gross amount of the dividends in all other cases.

The 2017 UN Model Convention also provides for similar restrictions, tabulated as under:

Article 10 – Dividends

Article 12A – FTS

a) per cent (the percentage is to be established through bilateral negotiations) of the gross amount of the dividends if the beneficial owner is a company (other than a partnership) which holds directly at least 25 per cent of the capital of the company paying the dividends throughout a 365 day period that includes the day of the payment of the dividend (for the purpose of computing that period, no account shall be taken of changes of ownership that would directly result from a corporate reorganisation, such as a merger or divisive reorganisation, of the company that holds the shares or that pays the dividend);

b) per cent (the percentage is to be established through bilateral negotiations) of the gross amount of the dividends in all other cases.

– “106……….. if the fraud is detected by the Court of Law, it can pierce the corporate structure since fraud unravels everything, even a statutory provision, if it is a stumbling block, because legislature never intents to guard fraud. Certainly, in our view, TRC certificate though can be accepted as a conclusive evidence for accepting status of residents as well as beneficial ownership for applying the tax treaty, it can be ignored if the treaty is abused for the fraudulent purpose of evasion of tax.”

Express intent to eliminate non-taxation/reduced taxation through tax avoidance schemes:

“A Covered Tax Agreement shall be modified to include the following preamble text: “Intending to eliminate double taxation with respect to the taxes covered by this agreement without creating opportunities for non-taxation or reduced taxation through tax evasion or avoidance (including through treaty-shopping arrangements aimed at obtaining reliefs provided in this agreement for the indirect benefit of residents of third jurisdictions),“

Prevention of treaty abuse:

“obtaining the benefit under a tax convention need not be the sole or dominant purpose of a particular arrangement or transaction. It is sufficient that at least one of the principal purposes was to obtain the benefit.”

Article 8 – Dividend Transfer Transactions:

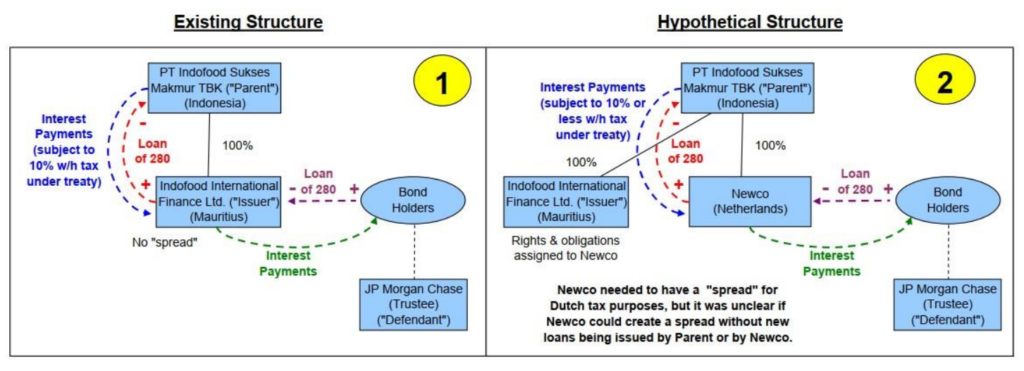

Facts

Decision

The Court of Appeal in England concluded that the Netherlands company would not qualify as the beneficial owner of the interest for the following reasons:

Even though the subject matter of the case was whether a Dutch company can be interposed or not to avail the treaty benefit, the Judgment stated that neither the Mauritian SPV nor the Dutch SPV qualified as “beneficial owner” and, therefore, were not entitled to claim the benefits.

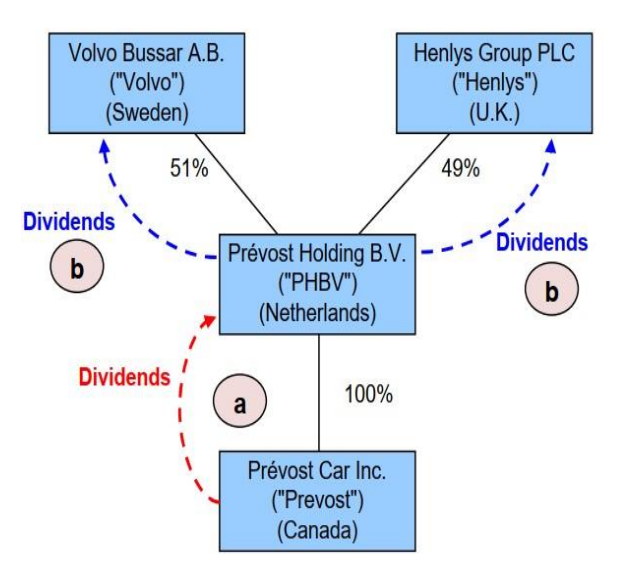

Facts

Decision

“the person who receives the dividends for his or her own use and enjoyment and assumes the risk and control of the dividend he or she received“.

“When corporate entities are concerned, one does not pierce the corporate veil unless the corporation is a conduit for another person and has absolutely no discretion as to the use or application of funds put through it as conduit, or has agreed to act on someone else’s behalf pursuant to that person’s instructions without any right to do other than what that person instructs it.”

Facts

Decision

“…the “beneficial owner” of dividends is the person who receives the dividends for his or her own use and enjoyment and assumes the risk and control of the dividend he or she received….When an agency or mandate exists or the property is in the name of a nominee, one looks to find on whose behalf the agent or mandatory is acting…When corporate entities are concerned, one does not pierce the corporate veil unless the corporation is a conduit for another person and has absolutely no discretion as to the use or application of the funds put through it as a conduit, or has agreed to act on someone else’s behalf pursuant to that person’s instructions without any right to do other than what the person instructs it…”

“It is quite obvious that though there might be limited discretion, VHBV does have discretion”.

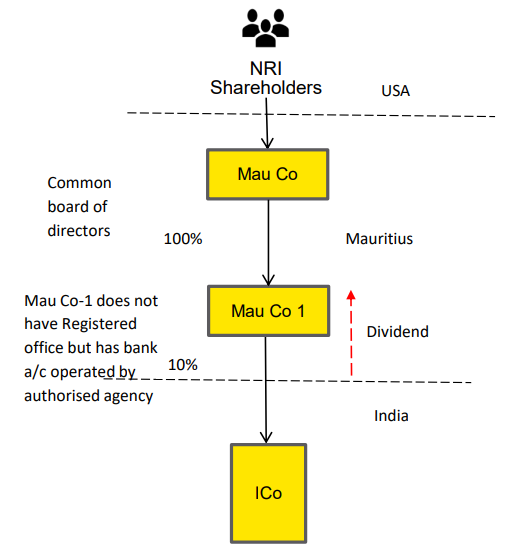

Facts

Decision

Facts

Decision:

The Supreme Administrative Court of Bulgaria decided the issue in favour of the tax authorities, holding as under:

Facts

Decision

The Supreme Administrative Court of Bulgaria held the taxpayer to be the beneficial owner basis the following:

Issue:

Issues:

Dividend

Capital Gain

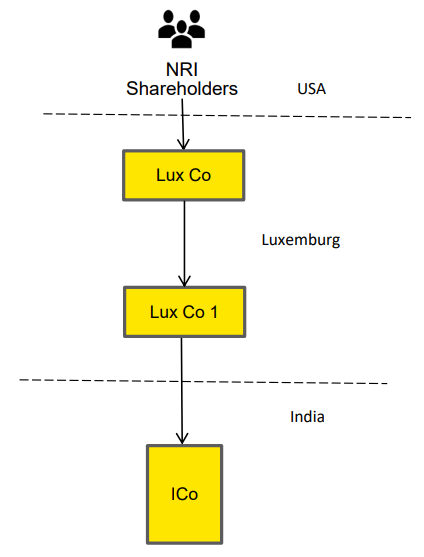

Facts

Decision of the Tribunal

“para 10.2 of the OECD Commentary (2017) on article 11 (Interest) of the ‘Model Tax Convention’ may be referred to, to appreciate the meaning of ‘beneficial owner’ and the same provides that where the recipient of interest does have the right to use and enjoy the interest unconstrained by a contractual or legal obligation to pass on the payment received to another person, the recipient is the ‘beneficial owner’ of that interest.”

Facts:

Decision

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content: